WITH NO. 1 NGO Fund specialist DINESH JAIN AT YOUR SIDE, YOU CAN

WITH NO. 1 NGO Fund specialist DINESH JAIN AT YOUR SIDE, YOU CAN

Dinesh's commitment to his clients is commendable. He does not make any false promises or overcommit himself. Instead, he focuses on delivering what he can within his capacity and ensures that his clients are well-informed about the risks and rewards of their investments.

Vinod , Meerut

FD:- While FDs provide a stable and predictable return on investment, the interest rates offered on FDs are generally lower compared to other investment avenues

Property:- Real estate is a relatively illiquid asset, meaning that it can be challenging to convert it into cash quickly. Selling a property can take time, and during market downturns, it may be more difficult to find buyers at desirable prices.

Gold:- Return is moderate but storing large quantities of gold can be challenging and may require additional security measures.

Stock Market:- Very good return but There is always a risk of losing some or all of your invested capital. The value of individual stocks can be affected by factors such as company performance, industry trends, economic conditions, and geopolitical events.

![]() FD:- While FDs provide a stable and predictable return on investment, the interest rates offered on FDs are generally lower compared to other investment avenues.

FD:- While FDs provide a stable and predictable return on investment, the interest rates offered on FDs are generally lower compared to other investment avenues.

![]() Property:- Real estate is a relatively illiquid asset, meaning that it can be challenging to convert it into cash quickly. Selling a property can take time, and during market downturns, it may be more difficult to find buyers at desirable prices.

Property:- Real estate is a relatively illiquid asset, meaning that it can be challenging to convert it into cash quickly. Selling a property can take time, and during market downturns, it may be more difficult to find buyers at desirable prices.

![]() Stock Market:- Very good return but There is always a risk of losing some or all of your invested capital. The value of individual stocks can be affected by factors such as company performance, industry trends, economic conditions, and geopolitical events.

Stock Market:- Very good return but There is always a risk of losing some or all of your invested capital. The value of individual stocks can be affected by factors such as company performance, industry trends, economic conditions, and geopolitical events.

Grow your money with india growth as india is becoming 7 Trillon Economy by 2028 .

Inflation erodes the purchasing power of money over time . Generally FD interest rate is less than inflation in india .

so the real value of investment decrease . In other words , your money does not grow enough to outpace the rising cost of goods and services.

In FD, Your money is locked in for a specified period, known as tenure, withdrawing the funds before the maturity date may result in penalties or a reduction in interest rates. The lack of liquidity can be a disadvantage if require immediate access to your funds in case of emergencies.

Combination of Equity & futures with safety

Calculated Risk

Index Based Strategy

Low Risk Profile

Strong Past Profile

Systematic Withdrawal

Transparency

No Lock In Period

Logical Period of Investment in 5 to 10 Years

Manage your wealth with Dinesh jain’s

Bulletproof Index with Insurance

Create your wealth with Dinesh jain’s Bulletproof investing with Hedging in Index

Dinesh generally charges ₹10,000 for an hour of consultancy, but for this month some slots are available for Free.

NGO Fund Specialist & Creator of B.I.W.I. Framework for creating secure wealth

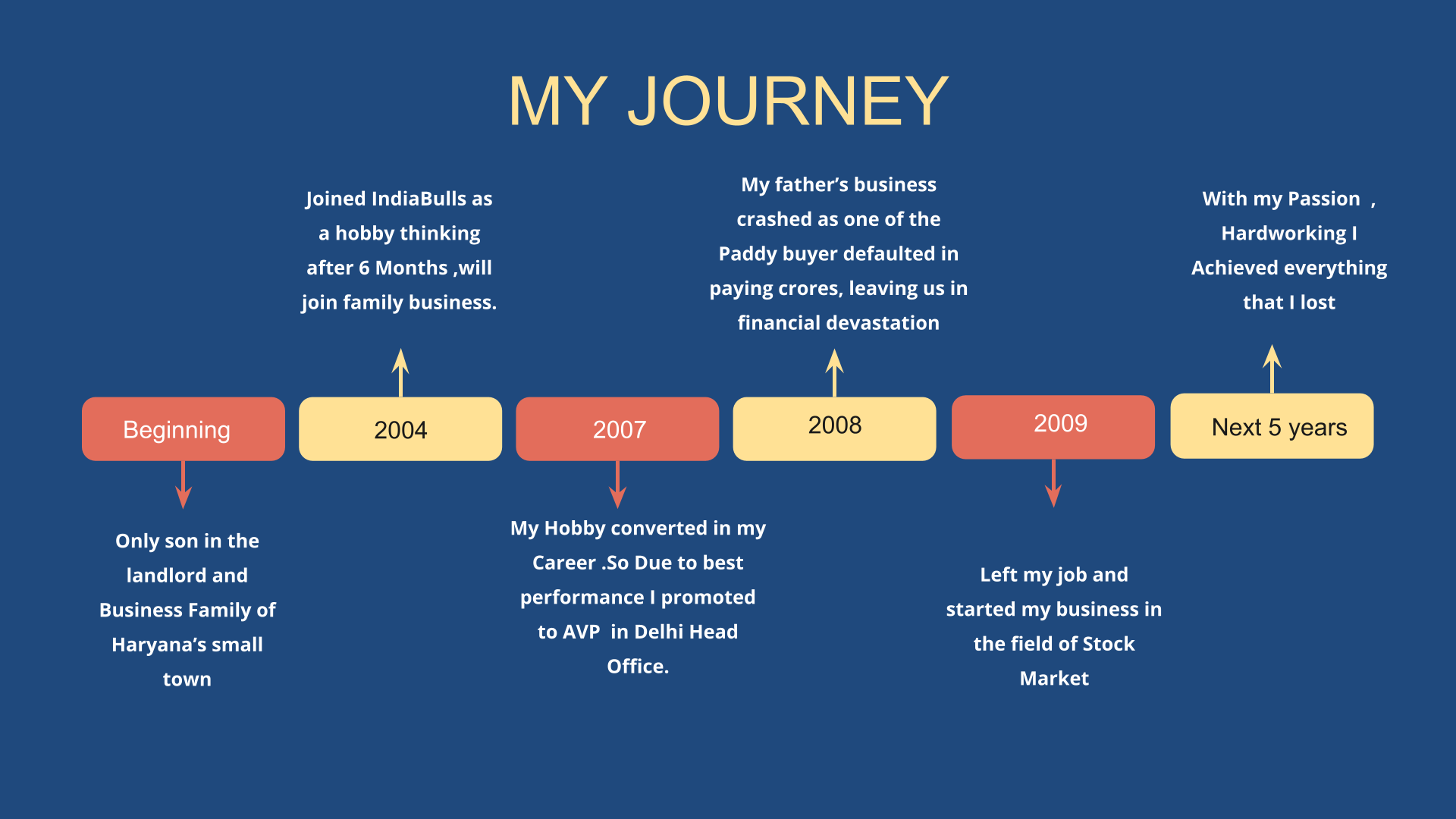

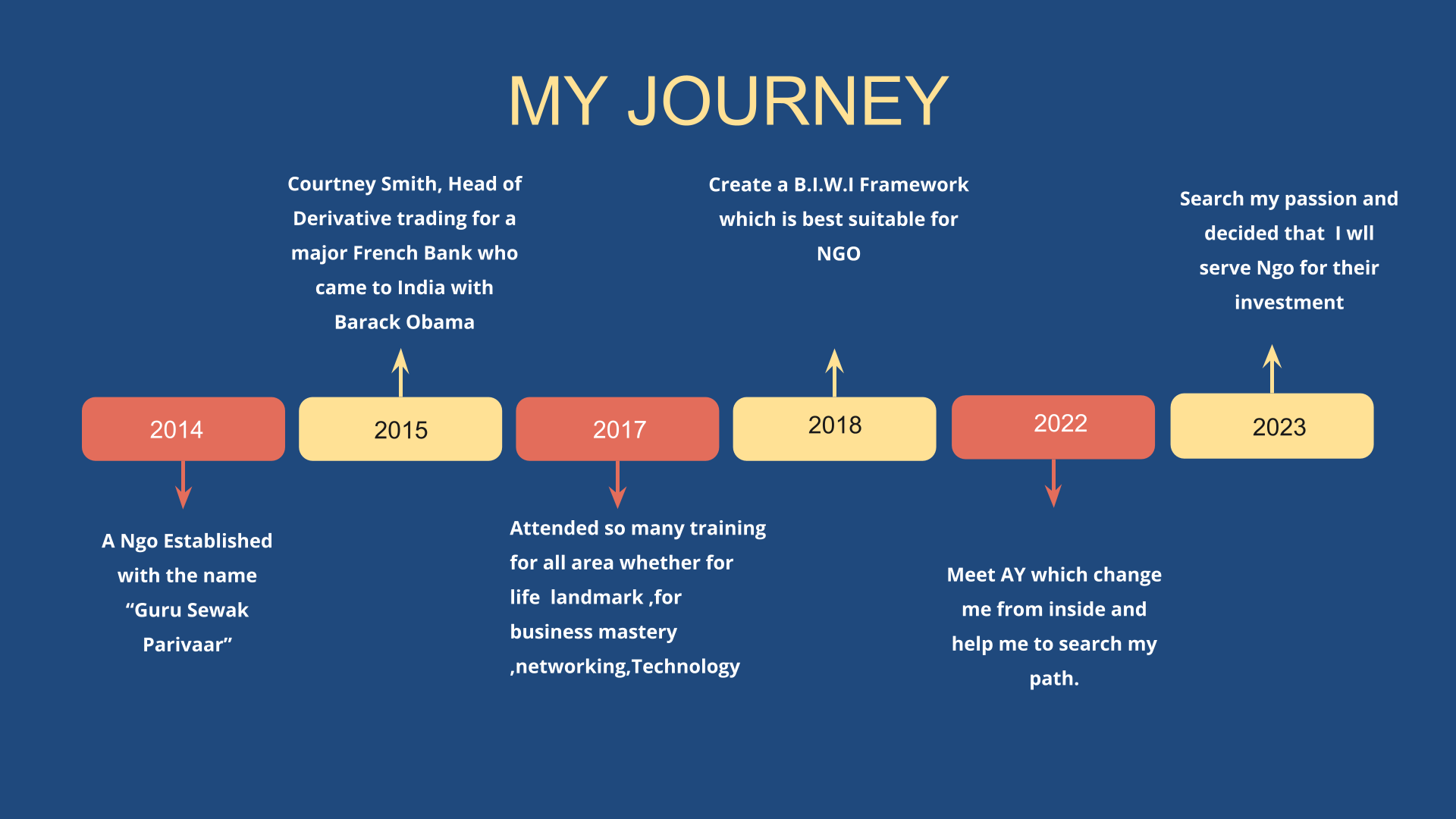

Although I was the only son of a big landlord and business family from Haryana

I joined Indiabulls Panipat Branch as an RM in 2005 just for some experience of a job after my post-graduation.

I used to enjoy my job in the stock market so within two years, i promoted to a branch manager

The company transferred me to the Delhi Head office After promoting me as an AVP.

Another side my family business was disturbed due to not getting crores of rupees from exporters to which we used to sell Farmer’s Paddy ( Rice raw Material )

After some years, due to compounding interest, the amount increased multiplied.

Then we returned back to Farmers after selling all our Assets.

Then I realized Two pain, one is to give our hard-earned money to anybody is very Risky, and second Because of compounding interest you can lose all your Asset if you have to give money.

Then I took the mission of creating a wealth of investors with minimal risk.

I start my own business in 2010 and within 5 years, I got back all that i loose in my parental business with my knowleage , passion and hard working.

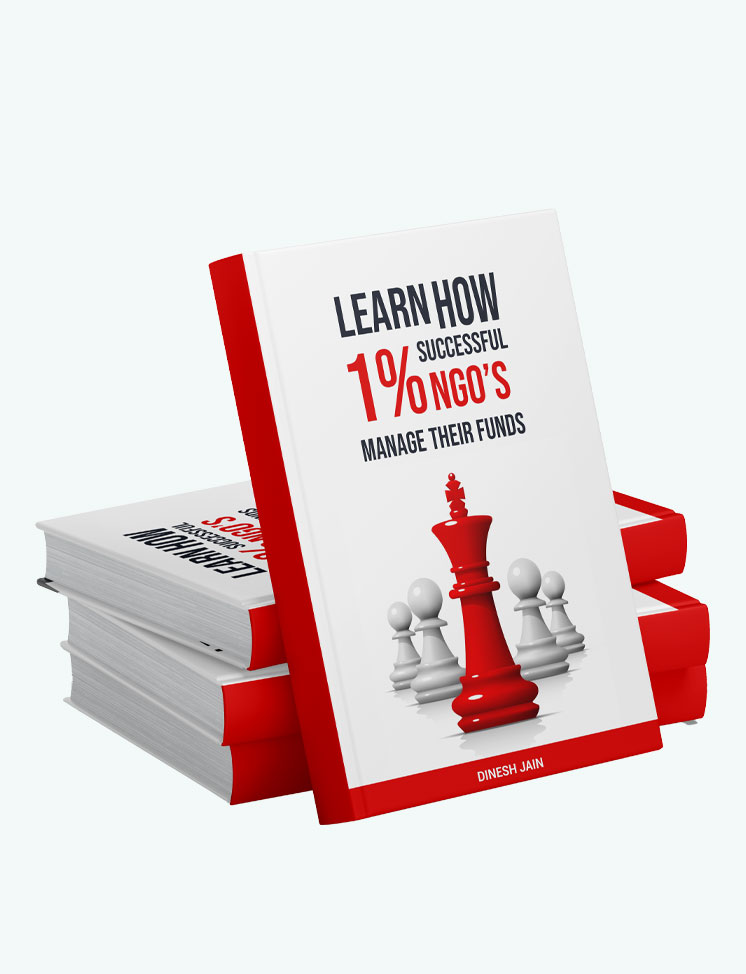

Read Dinesh’s Latest Book To Get BulletProof Investing

Be the first to read this comprehensive financial guide. Pre-book your FREE copy today.

Dinesh is an exceptional fund manager who is known for his commitment, honesty, and simplicity. These traits make him a valuable asset to any investor looking for a trustworthy and reliable partner in their financial journey.

– Sahil

I have always been afraid of the stock market because I heard Stories of people losing their hard-earned money. however, Dinesh’s Framework involves careful research and analysis of the market, as well as a long-term investment approach

– Pankaj Jain

Many investors find themselves hesitant and unsure when it comes to investing in the market. They lack a reliable investment strategist who can provide thorough guidance on navigating the complexities of the market and making secure investment choices.

Fortunately, there is a solution. Dinesh is here to offer refuge and assist you in finding the most secure investment opportunities. With his expert guidance, you can unlock the potential for remarkable wealth growth that outperforms market benchmarks, all while minimizing downside risks.

This is how Dinesh Helps You Out:

Begin by scheduling an initial consultation with a financial consultant to discuss your investment goals, risk tolerance, and financial situation.

Conduct a comprehensive risk assessment to determine your comfort level with risk and align it with the index fund investment strategy.

Analyze your existing investment portfolio to identify any gaps or areas that can be optimized for index fund investment.

Develop a tailored investment strategy based on your goals, risk profile, and the unique features of index fund.

Take the necessary steps to implement the investment plan, including opening accounts, transferring funds, and making investments in index fund.

Continuously monitor and review the performance of your index fund investment to ensure it remains aligned with your goals. Make adjustments as needed.

Maintain open and regular communication with your financial consultant to stay informed about the progress of your index fund investment and address any questions or concerns that may arise.

Dinesh’s system liberates clients from the doom spiral, propelling them towards astronomical growth in perfect harmony with their vision.

Unlock greater profitability with Dinesh’s guidance.

In our exclusive 1-on-1 session, you’ll gain insights on: